Business Credit Cards

Secure cards for your company

Profit from your expenses

| Card Type | APR |

|---|---|

| Platinum Business | As low as 16.85% |

| Platinum Business Rewards | As low as 17.9% |

Both card options include these benefits:

Side-by-side Card Comparison

Business Platinum

The Business Platinum credit card is perfect for those everyday business expenses. And as one of the lowest interest rates, it’s the most budget friendly card in the industry.- great option for small business owners

- fantastic choice for bringing over an old balance

- save money on interest

- 24/7 card support

Business Platinum Rewards

Get more for your money with a business credit card from Deseret First. You can earn reward points for every dollar that your business spends. Our Business Platinum Rewards VISA comes packed with rewarding features. Yes, even including cash back!- $1 spent = 1 point

- hundreds of rewards options available

- bonus, double, and triple point reward promotions offered throughout the year

- 24/7 card support

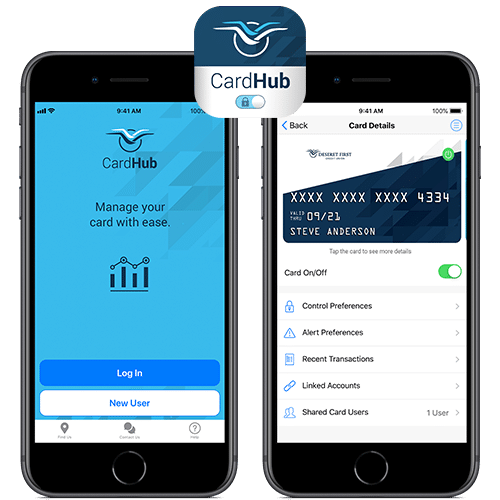

Track Your Spending

About Online Banking

Card Requirements

To receive a credit card with DFCU, business owners must:

- meet membership eligibility requirements

- have approved credit

Lost or stolen card?

CardHub Details