Skip-A-Pay Program

Flexibility for Everyone

Stretch your budget with DFCU

Online Banking Login

Benefits of Skip-A-Pay

How to Skip a Payment

Don’t worry, it is quite simple and easy to do! Here are a few steps for you to follow.

- Log in to your Online Banking Account.

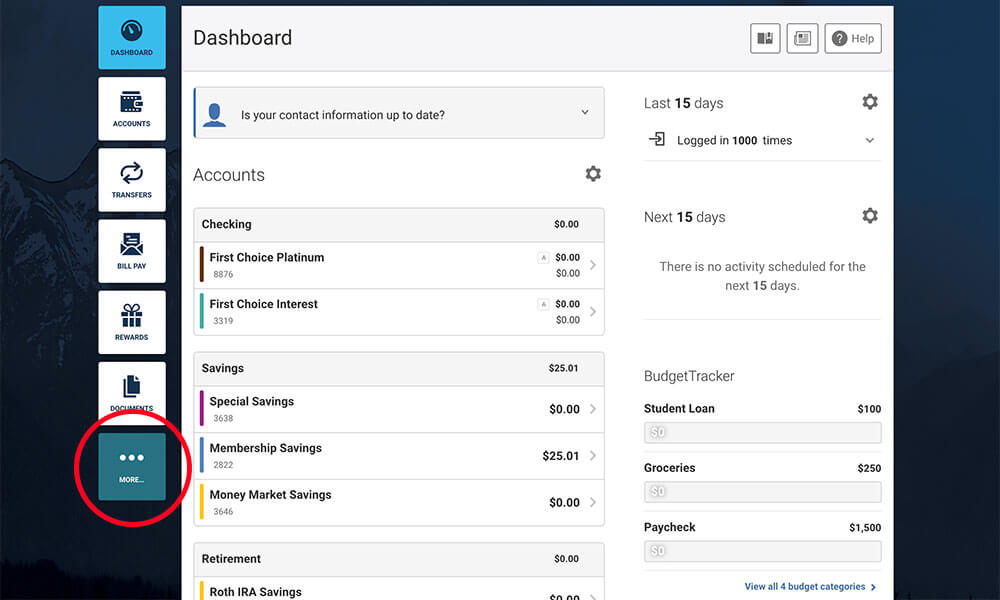

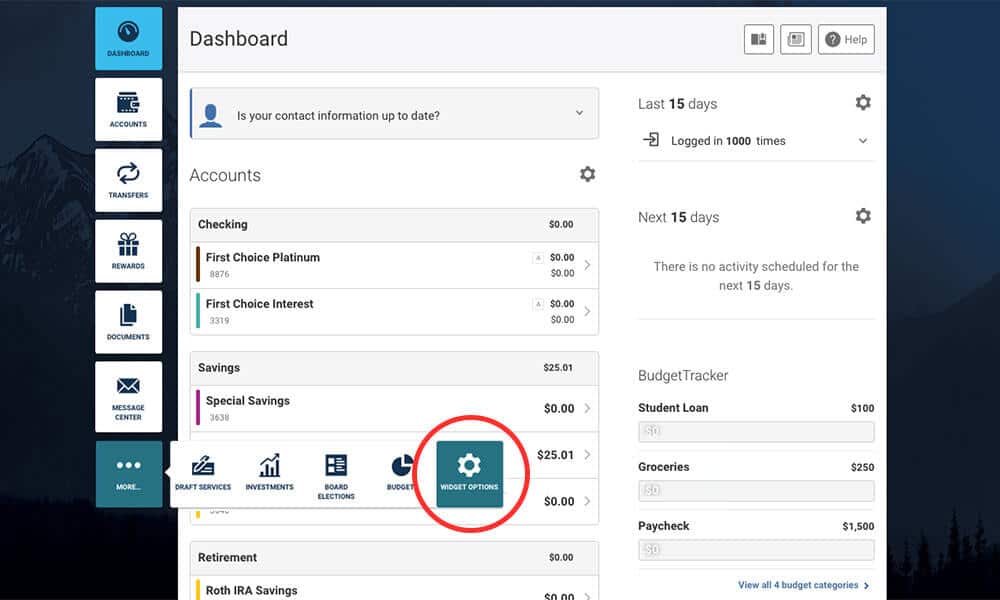

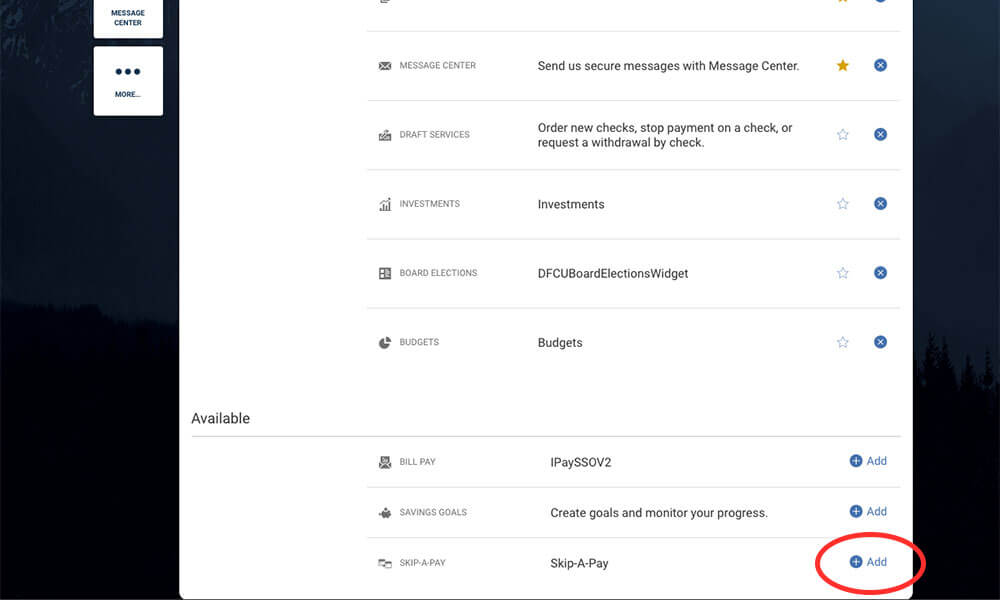

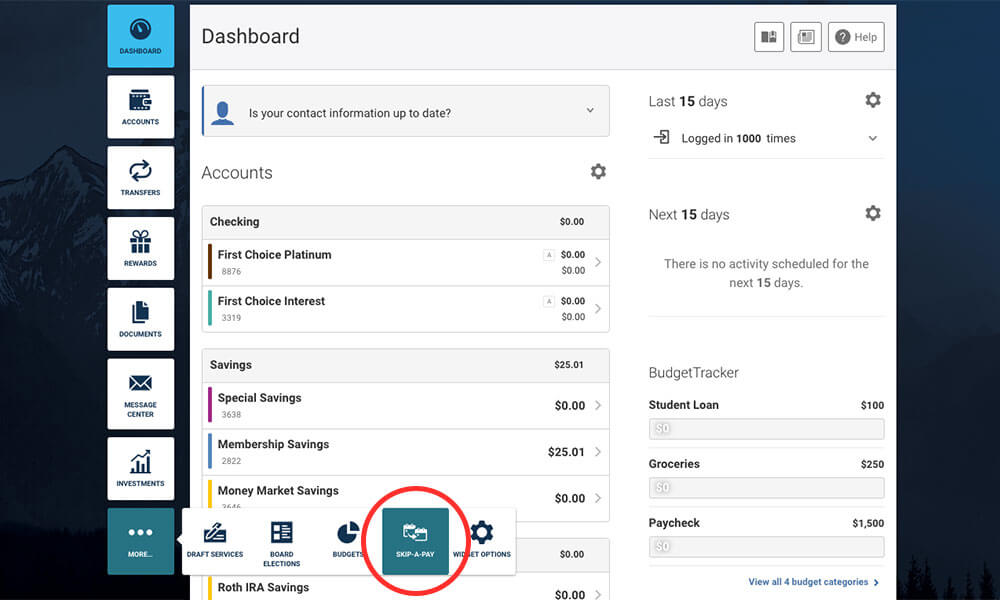

- Click the Skip-A-Pay widget (looks like the picture below). If you don’t see the widget on the left

vertical menu, go to “More” on the same menu, “Widget Options” and add the “Skip-A-Pay” widget. It will

then show on your left vertical menu.

- Follow the prompts to let us know which loan you’re wanting to skip.

- You’re finished and have a little extra room in your budget for that month!

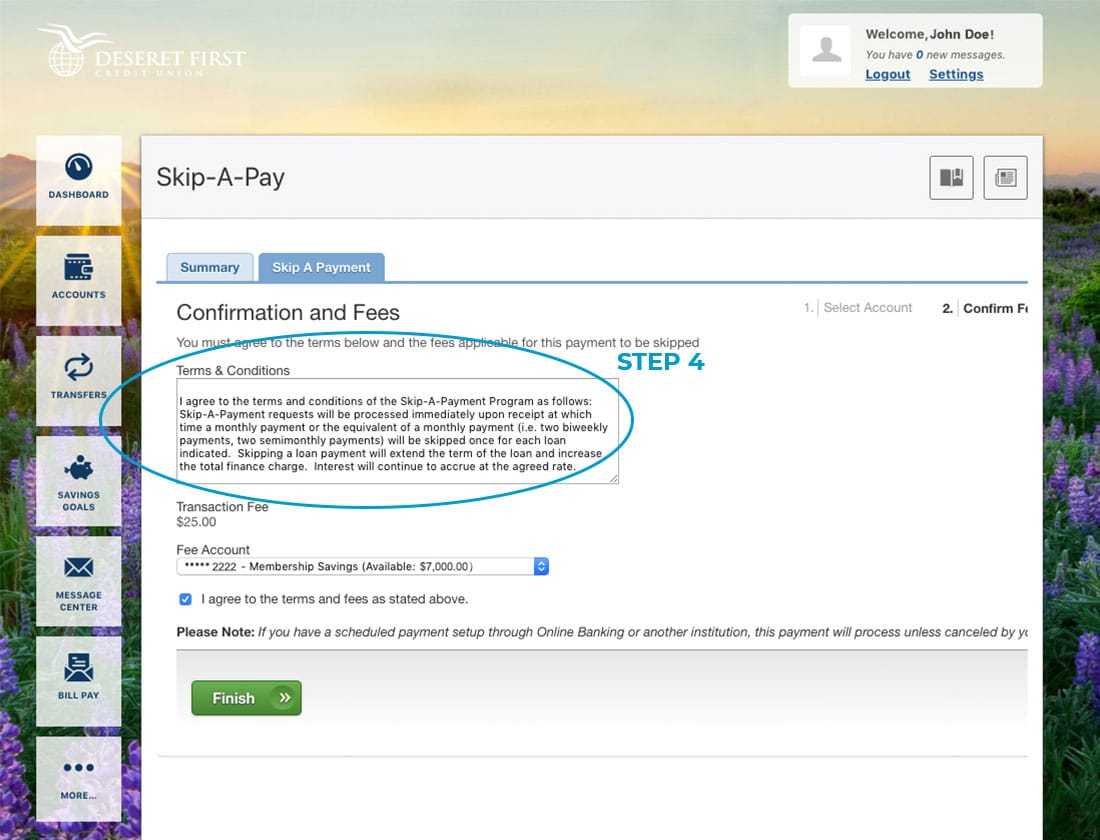

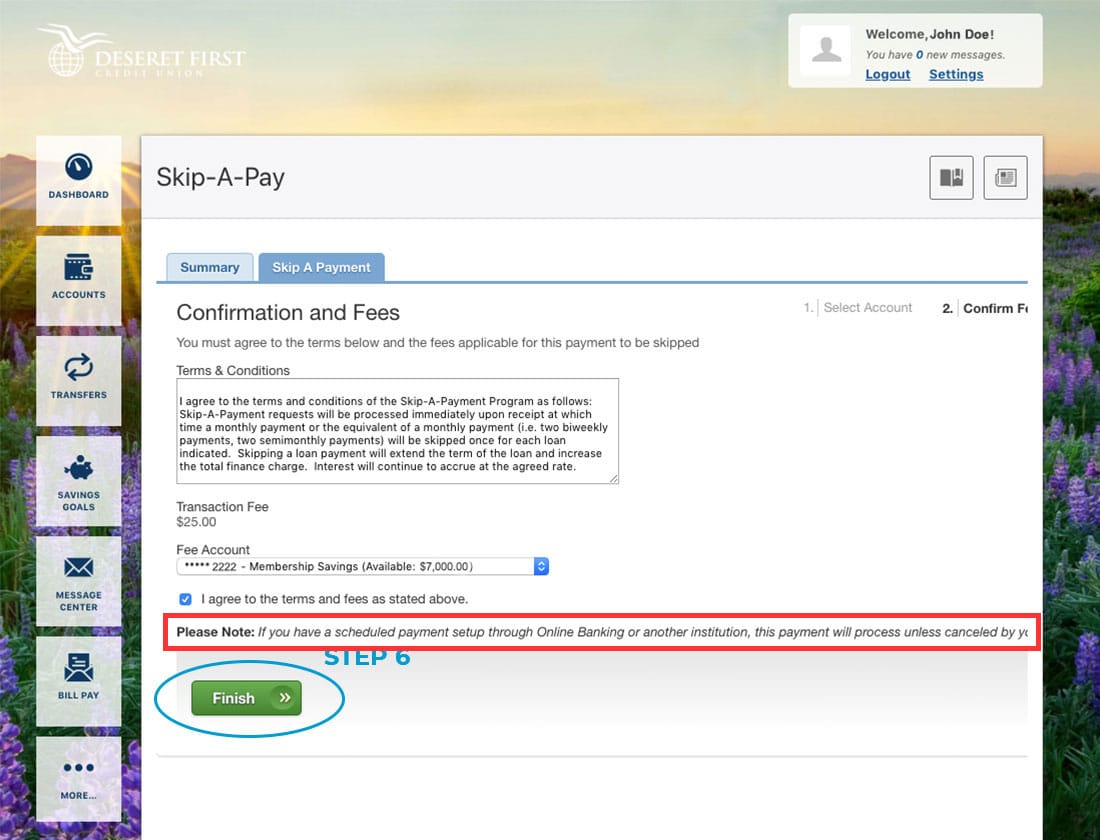

After skipping your payment, please remember to request a one-time stop on any scheduled or ACH payment through online banking or another institution. Otherwise, your payment will still process.

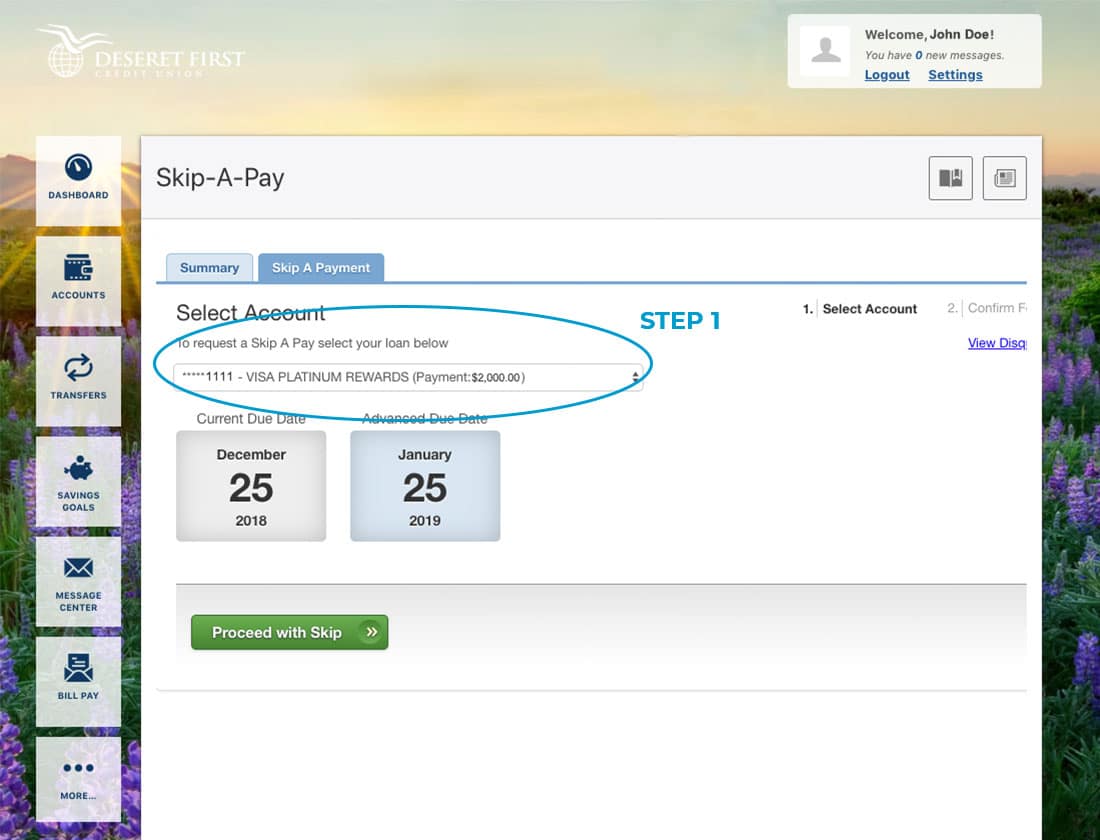

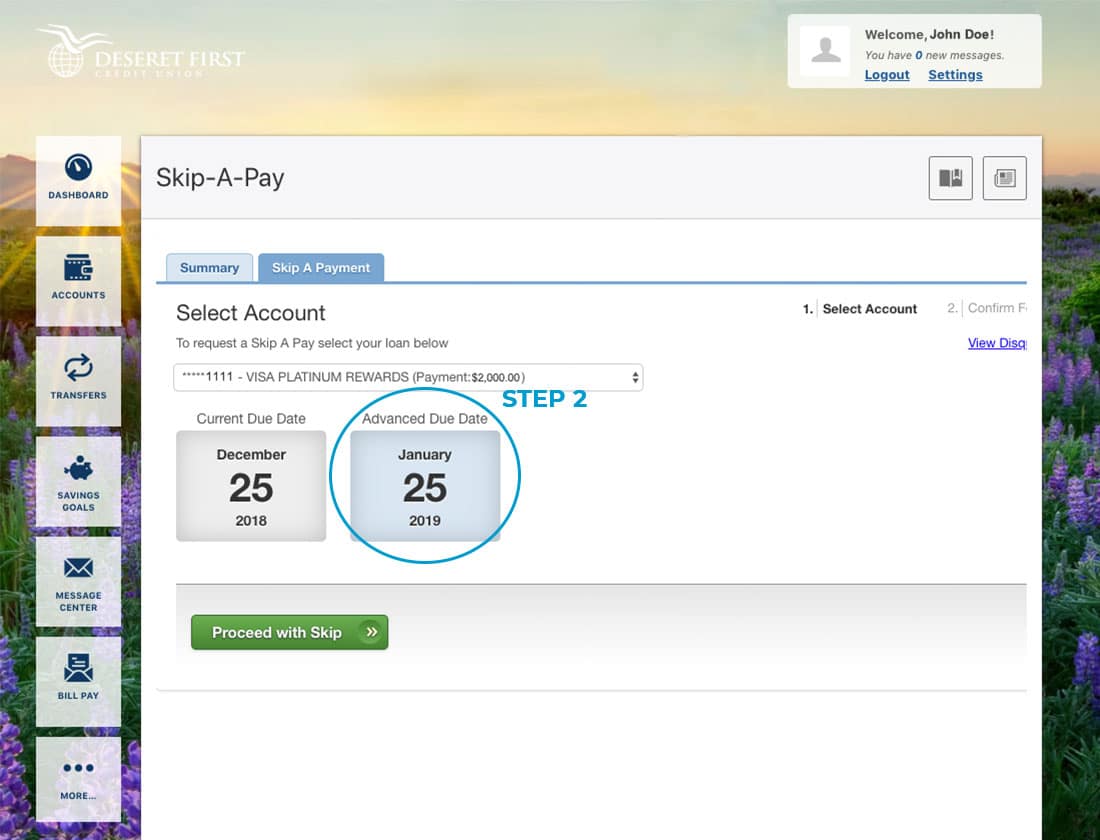

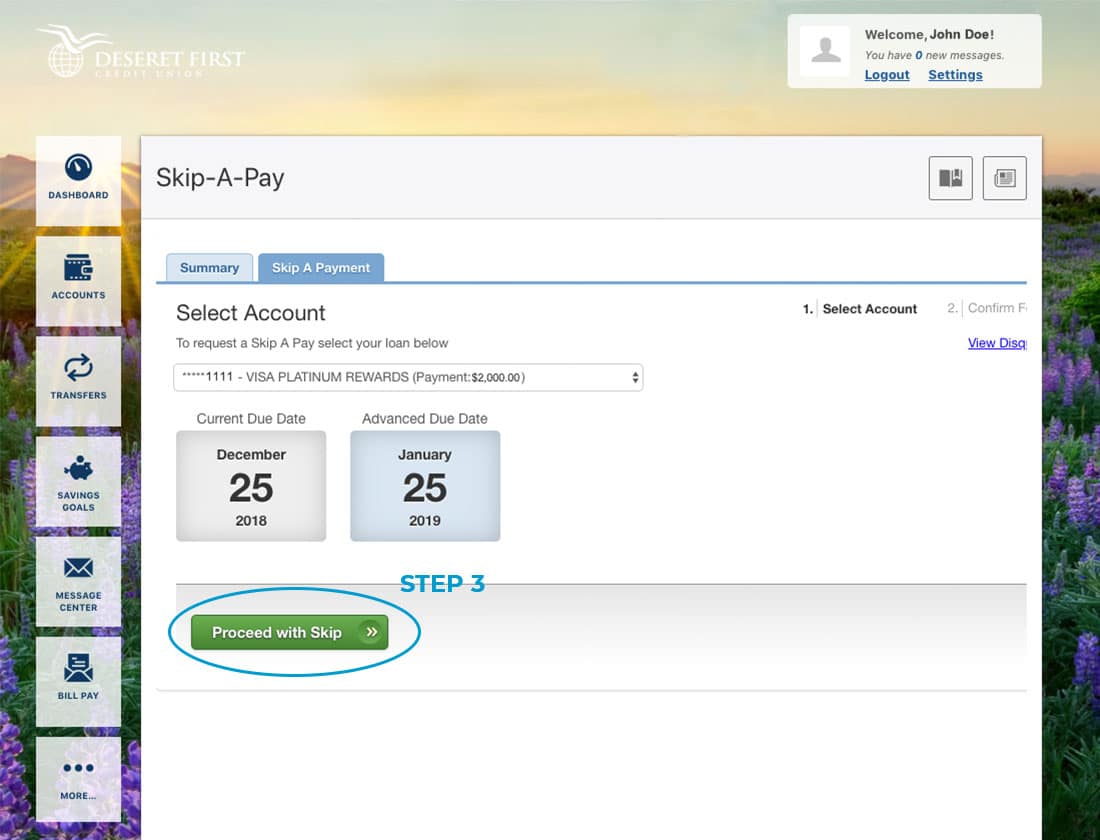

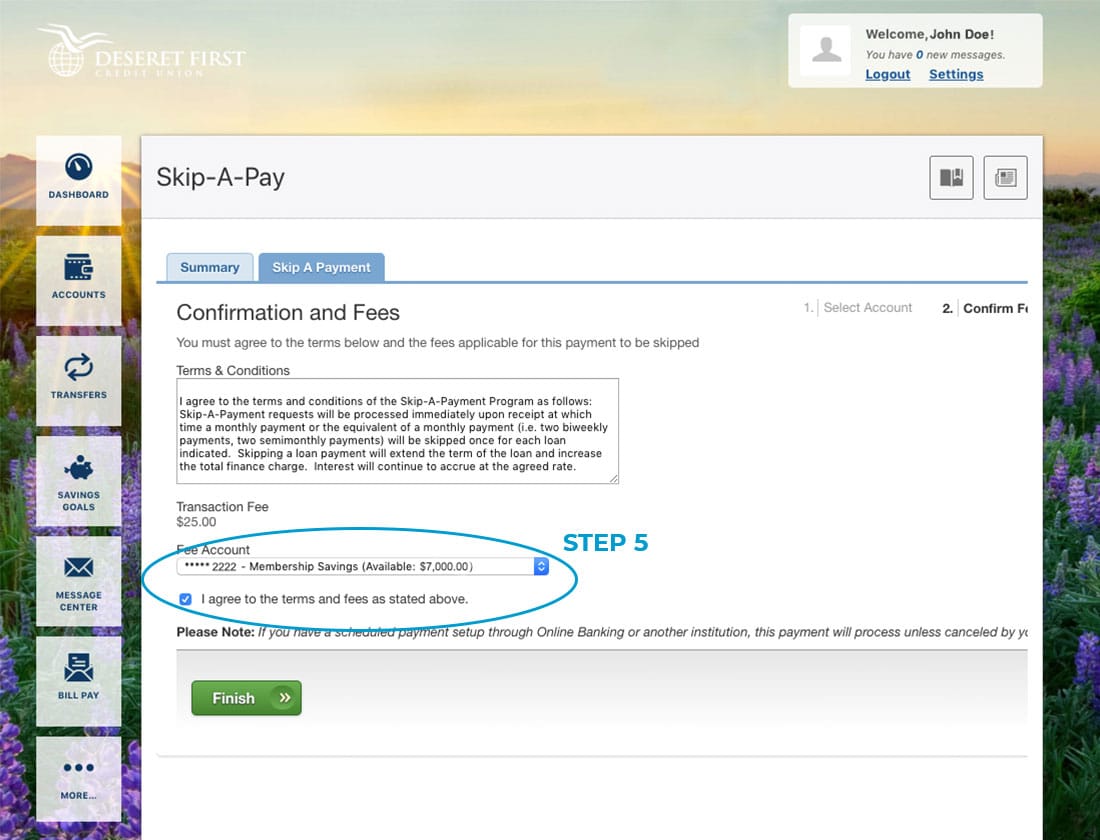

Steps within Online Banking

We’ve created the following slideshow in case you need a little extra guidance! It includes the steps you need to take once you’ve selected the Skip-A-Pay widget in Online Banking.Requirements

- Loans must be current to take part

- You must be one of the owners on the loan

- There is a small fee** associated with skipping payments. So to proceed with skipping your payment, there must be enough in one of your DFCU accounts to cover this fee

- Your DFCU accounts cannot be overdrawn for more than 30 days

- Your DFCU accounts cannot be overdrawn more than $950

- The loan you want to skip a payment on cannot have been delinquent for a period of 60 days within the last 6 months

- Cannot have a CPI (Collateral Protection Insurance) in place on the loan you want to skip

- Loan you want to skip must be open at least 120 days previous