You’ve got questions

We’ve got answers

Frequently Asked Questions

Below you’ll find a list of some general questions. If you’re experiencing problems with online banking or our apps, first check here for solutions. Still not finding the answers you need? Call us at 801-456-7000 or stop by a branch location.

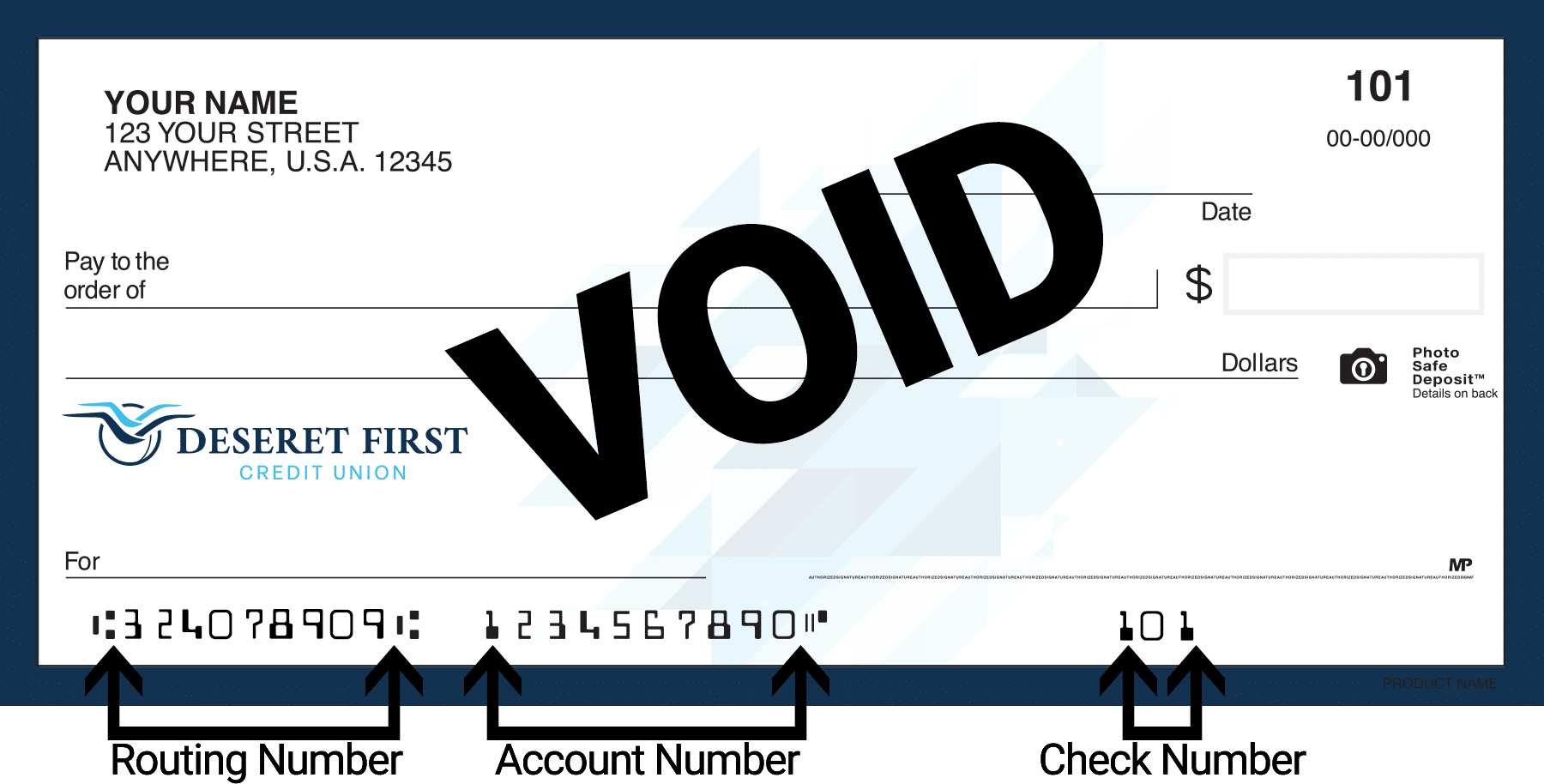

ABA Routing Number: #324078909

The routing or ABA number is used for many purposes, including wire transfers, checks, direct deposits, bill pay, etc. Below you will find some important information you might also need when you’re asked for Deseret First’s routing number.

Institution Name: Deseret First Credit Union

Institution Address: P.O. Box 45046 Salt Lake City, UT 84145

Direct Deposit Form: Click here to download the PDF

Your Account Number: Can be found on your checks, under account names in online banking, or by visiting or calling a branch. See below to find where your number is located on a check.

You qualify for membership with DFCU if you are:

- A member of The Church of Jesus Christ of Latter-day Saints.

- An employee of The Church of Jesus Christ of Latter-day Saints. Or additionally any of our Employer Groups.

- Have an immediate family member of a person who is a current member of Deseret First or is eligible to join Deseret First.

- An employee of Deseret First Credit Union.

You may also view the full membership requirements here.

Ordering for the first time?

If you’ve never had checks with your Deseret First account before, you’ll need to talk to a Member Services Rep. You can contact us through Online Banking, the DFCU Mobile App, over the phone, or at a branch. You’ll need to verify your information for us and we can help you.

Login to online banking now, find a location near you, or give us a call: 801-456-7000 or 800-326-3328. Available by phone Mon–Fri: 8am–7pm, Sat: 9am–2pm.

Do you need to re-order checks?

If you just need to re-order checks, you can order directly through Harland Clarke. Click the link below to order.

Order ChecksSpecial benefits are available for employer group members.

We offer a package of special rates, rewards, and discounts. These benefits are exclusively offered to these employees only. See here for a full list of eligible companies.

Benefits include:

- $100 with a new First Choice Checking Account and Direct Deposit added*

- 0.25% APR discount on auto loans

- 0.25% APR discount on credit cards**

- 15,000 bonus points on a new VISA Platinum Rewards Card

- $200 off closing costs on eligible mortgages

- Additional 0.10% APY on new share certificates

*We add the $100 within thirty (30) days of opening an account and after your first direct deposit. The $100 bonus is treated as interest income for tax reporting purposes. Valid only for new First Choice Checking accounts. Limit one $100 bonus per member.

**DFCU credit cards range from 8.9–18.00% APR. This rate is dependent on factors such as your credit worthiness and the type of card you choose. Our credit cards have a 1% foreign transaction fee on purchases and a 1.5% cash advance fee.

You’ll want to check out our locations page.

There you’ll be able to search for one of our 13 DFCU branches, hundreds of shared branches, or thousands of ATM locations.

Our branches and contact center will be closed on:

New Year’s Day: Monday, January 2, 2023Martin Luther King Jr. Day: Monday, January 16, 2023

Presidents Day: Monday, February 22, 2023

Memorial Day: Monday, May 29, 2023

Juneteenth: Monday, June 19, 2023

Independence Day: Tuesday, July 4, 2023

Labor Day: Monday, September 4, 2023

Columbus Day: Monday, October 9, 2023

Veterans’ Day: Saturday, November 11, 2023

Thanksgiving Day: Thursday, November 23, 2023

Christmas Day: Monday, December 25, 2023

We partner with CO-OP Financial Services to ensure complete accessibility for our members.

As a DFCU member, you get access to 5,600 credit union branches across the United States. Each branch can conduct basic transactions for members of other participating credit unions, which puts you in the 2nd largest financial network in the country!

Any of our branch locations can help you reset your debit card’s PIN. Use our map to help you find a nearby location. You can also call 866-762-0558 to reset by telephone, or via the CardHub section of our mobile app.

Call us at 801-456-7000.

When you get to the automated menu, select the number that leads you to talk to a card specialist and we will send you a new/replacement card within 5-7 business days free of charge. If you need a card quicker, stop by a branch! They can instantly issue a replacement for you.

If for some reason, you’re unable to call us, you can also use the DFCU Mobile App.

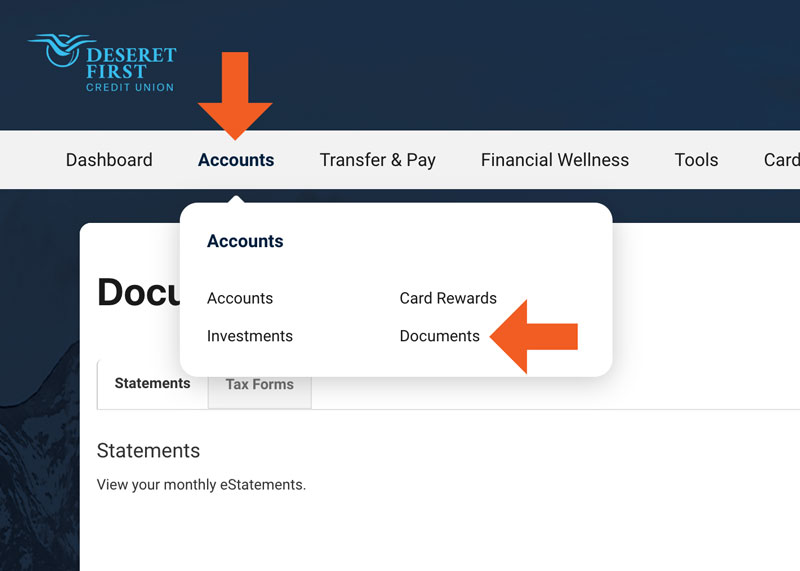

To view your statements, log into either Online Banking or the DFCU Mobile App under Accounts > Documents > Statements. You can select each statement to view more details and print them.

You can find all our current interest rates listed here.

Please keep in mind, the rates listed are our best available rates. All rates are dependent on credit worthiness. Your rate offered could be different.

Yes! Simply complete our online loan application.

Not only can you apply online, but you can digitally sign for your loan as well. We strive to make the lending process quick and easy! Likewise, we offer both consumer loans and mortgages. You can complete each option 100% online (except for reverse mortgages).

Yes! Head over to our online member application page.

Soon you’ll be on your way to a different kind of banking! You can get approved and sign for your account with an e-signature entirely over our secure network.

We offer an exciting credit card rewards system!

These are points given for making purchases with our reward credit cards. You earn 1 point for every dollar spent! Get more details about the program by visiting our Visa Platinum Rewards Card page.

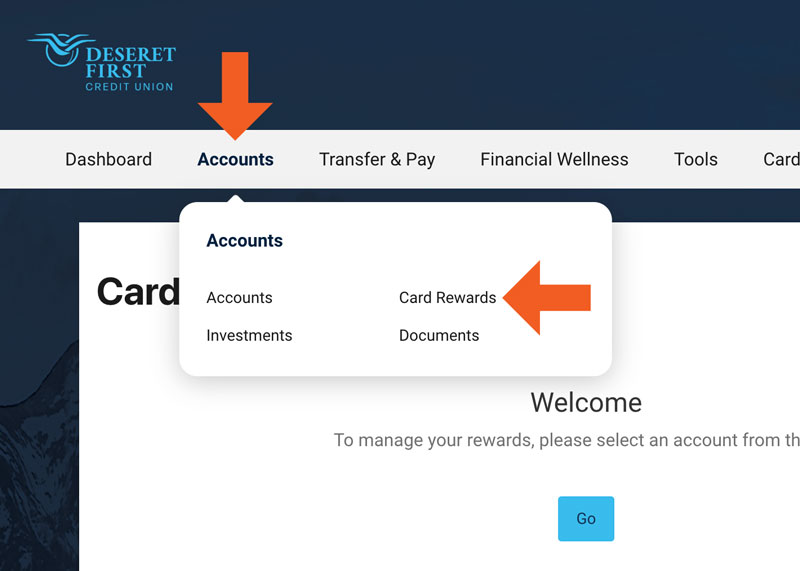

You can access you VISA Rewards Balance through DFCU’s Online Banking or Mobile App by using the following navigation: Accounts > Card Rewards > Go

Login to either Online Banking or the DFCU Mobile App and then use the following navigation: Accounts > Card Rewards > Go. From here you can view and redeem your points! If you have the points you need, select the reward you want, add it to your cart, and check out! Additionally, you can call the redemption center toll-free at 888-204-4482.

Sending a wire transfer? Here’s how.

Visit a branch or give us a call at 801-456-7000 or 800-326-3328.

You will need the following information to send the transfer.

- Their Financial Institution Information: Institution Name, Address, and Routing Number

- Their Personal Information: Name, Address, and Account Number

Are you receiving a wire transfer? Here’s the information you need to give the person sending the wire.

Domestic (Within the United States)

- Beneficiary Financial Institution: Deseret First Credit Union

- Address: 3999 W. Parkway Blvd. West Valley City, Ut 84120

- Routing Number: 324078909

- Beneficiary: Your Name

- Account: The Account Number you want the funds in

International

- Beneficiary Financial Institution: Zions Bank

- Address: One South Main Street Salt Lake City, UT 84133

- Swift Code: ZFNB US55

- Beneficiary: Deseret First Credit Union

- Address: 3999 W. Parkway Blvd. West Valley City, Ut 84120

- DFCU’s Account at Zions: 324078909

- For Further Credit To*

- Member Name

- Member Address

- Member Account

*Include as part of notes in Originator to Beneficiary Information

What Amount will be charged for wiring money?

- Incoming Domestic: $10

- Outgoing Domestic: $20

- Incoming for Mortgage Payoff: $20

- Incoming Foreign: $20

- Outgoing Foreign: $40

See our Fee Schedule if you want more information

Here’s a breakdown of tax forms that we send:

| Form | Title | Report Limits | Date to Be Mailed |

|---|---|---|---|

| 1098 | Mortgage Interest | $600 or more | January 31st |

| 1099-INT | Interest Income | $10 or more | January 31st |

| 1099-R | IRA Distributions | All amount | January 31st |

| 5498 | IRA Contributions and information | All amounts | May 31st |

Information can also be found within our Online Banking and the DFCU Mobile App under Accounts > Documents > Tax Forms.

The credit union’s Utah State ID number is 11767687005WTH.

The WTH at the end is required. Some tax software programs (i.e. Turbo Tax) require you to input the credit union’s state ID number. But typically you won’t need it unless you have state withholdings from your interest earned.