VISA Debit Cards

Quick, simple, secure payments

Visa Debit Card Basics

Get an account

Our debit cards include:

Checking Accounts & Card Types

Compare Checking OptionsDebit Cards vs Credit Cards

How do I know which is best for me?

Debit and credit cards function in a very similar way. So it can be easy to interchange the terms. But we can help you make the distinction. If you’re still unsure which option will be the best fit for you, why not run the numbers? We have a checking account rewards calculator so that you can maximize your benefits.

Calculate benefits

Debit Cards

- Uses your own funds that you’ve deposited

- Purchase limit defined by the amount in your account

- Easier to control your spending

- Can be used with a PIN

- Allows cash back from retailers

Credit Cards

- Borrow funds up to your credit limit

- Credit limit is determined by your ability to pay the loan back

- Shows on your credit report

- Interest accrues on unpaid balances

- Earn rewards or cash back

Lost or stolen card?

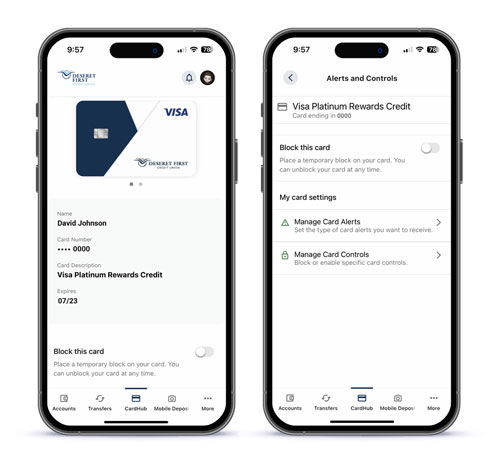

CardHub Details