Business Credit Cards

Find the right card for your business

Profit from your expenses

Choose from three business credit cards designed to fit how you spend, manage expenses, and grow your business. Whether you want competitive rates, rewards, or premium benefits, there’s a card that works for your business needs.

| Card Type | APR |

|---|---|

| Business Platinum | As low as 16.85% |

| Business Platinum Rewards | As low as 17.9% |

| Business Signature | As low as 18% |

The annual percentage rates (APRs) listed here represent our best available rates. Your individual rate may be higher depending upon your creditworthiness. Membership and eligibility required. Offer subject to change. Additional products and rates are listed here.

All card options include these benefits:

Side-by-side Card Comparison

Business Platinum

Best for everyday business spending.- great option for small business owners

- fantastic choice for bringing over an old balance

- save money on interest

- 24/7 card support

Business Platinum Rewards

Best for flexible credit and purchasing. Earn reward points when you use it.- $1 spent = 1 point

- hundreds of rewards options available

- bonus, double, and triple point reward promotions offered throughout the year

- 24/7 card support

Business Signature

Best for premium business spending & benefits.- Enhanced spending power

- Premium Visa® benefits

- Competitive rate and features tailored to larger or growing businesses

- 24/7 card support

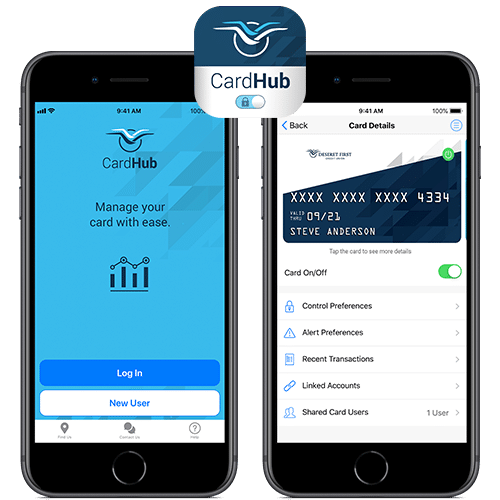

Track Your Spending

You expect accessibility for your money. With DFCU’s online & mobile banking, you’ll get it. For example, check your spending whenever and wherever you want. So whether you need to issue many cards, or want easy-to-use banking tools, we have you covered. Further you’ll be able to download account details, link to Quickbooks, and view accounts 24/7.

About Online Banking

About Online Banking

Card Requirements

To receive a credit card with DFCU, business owners must:

- meet membership eligibility requirements

- have approved credit

Lost or stolen card?

If you ever lose your VISA card, we are ready to assist you 24/7. Call us toll free at 800-326-3328. When you get to the automated menu, select the number that leads you to talk to a card specialist. You can also use the number above to request a new card and we will send you a replacement free of charge. Additionally, if you need a new card quicker, stop by a branch! They can instantly issue a replacement for you.

If for some reason, you’re unable to call us, you can also block your card using CardHub.

CardHub Details

CardHub Details